The Great Economic Realignment: Tariff Tantrum, Bitcoin Resilience, and Cyber Risks

In an era of rapid economic transformation, President Trump’s “Liberation Day” tariffs signal a bold pivot toward revitalizing American manufacturing and reducing reliance on foreign trade, sparking both market volatility and optimism for long-term resilience. Amid this shift, Bitcoin’s surprising stability during turbulent markets underscores its emerging role as a “digital real estate” asset, while the digital asset landscape matures with utility tokens and stablecoins redefining financial infrastructure. However, significant risks—ranging from cybersecurity threats targeting critical infrastructure to vulnerabilities in America’s power grid and sophisticated social engineering attacks—demand vigilant preparation. This article explores the interplay of these economic policies, market dynamics, and emerging threats, offering a comprehensive analysis of the opportunities and challenges shaping the future of the U.S. economy.

Bottom Line Up Front (BLUF)

-

- Trump’s “Liberation Day” tariffs seek to rebuild American manufacturing and reduce foreign dependency, causing short-term market volatility but potentially delivering long-term economic resilience.

-

- Bitcoin demonstrated surprising resilience during the market selloff following tariff announcements, gaining 12% while the S&P 500 declined 2%, suggesting its potential emergence as a “digital real estate” or safe haven asset.

-

- The Department of Justice has disbanded its National Cryptocurrency Enforcement Team, signaling a regulatory shift from government prosecution to civil litigation that transfers due diligence responsibility to investors.

-

- The digital asset landscape is maturing with Bitcoin functioning as “digital real estate,” utility tokens creating genuine value, and stablecoins providing practical financial infrastructure that could reinforce dollar dominance.

-

- Critical cybersecurity threats to American infrastructure, power grid vulnerabilities, and sophisticated social engineering attacks present significant risks that all businesses and investors should prepare for.

2025 Tariff Tantrum

President Trump’s tariff policies represent a shift toward real economic growth that strengthens the middle class rather than short-term profiteering that fails to create lasting value for lower- and middle-class Americans. However, even with the rosy long-term vision of a bolstering innovative future US economy, the immediate market reaction has been volatile, and higher consumer prices seem likely in the short term. But it is our belief that these policies will bring real growth back to the US. Real growth in the form of stronger domestic manufacturing base and reduced dependence on foreign nations; not protectionism or autarky, but a US economy entrenched in future industries that will inevitably dominate international trade. Furthermore, they also present one hell of a bargaining chip for eliminating the income tax, should businesses decide to pass costs on to consumers. In short, we see theses tariffs as both a negotiation tactic and general shift toward real growth in the economy.

Short-Term Pain for Long-Term Gain

The emotional cognitive dissonance associated with this tariff policy is akin to jumping back under the squat rack and maintaining a healthy diet, after years of sitting on the couch eating potato chips. Similarly, while the costs of strengthening America’s internal economic infrastructure may be substantial in the near term – and likely exacerbated by the mainstream media because their funding comes from the very corporations who will experience the most pain from it – the potential for a more resilient and self-sufficient economy is real. This can succeed so long as high-level policies are supplemented with measures that help small businesses and domestic manufacturers thrive.

Policy Crossroads: Balancing Competing Interests

However, implementing such transformative economic policies requires navigating complex competing interests. The immediate financial impact on multinational corporations and import-dependent industries creates significant pressure on policymakers who must weigh short-term economic disruption against potential long-term national benefits. The challenge lies in developing supporting frameworks that buffer transitional hardships while allowing domestic manufacturing to rebuild and strengthen. Success depends largely on whether economic policy can remain consistent enough to allow businesses to adapt and invest with confidence, rather than changing course with each election cycle. This requires transparent communication about both the costs and benefits, maintaining focus on long-term economic resilience rather than quarterly earnings reports or election timelines, and fostering genuine bipartisan commitment to American manufacturing renewal.

The Verdict of Time: Renaissance or Misstep?

The ultimate success of this economic realignment will depend on numerous factors, including the willingness of trading partners to negotiate fairer terms, the ability of American businesses to adapt to the new economic reality, and the patience of American consumers during the transition period. Only time will tell whether Trump’s “Liberation Day” will be remembered as the beginning of an American manufacturing renaissance or a costly economic misstep.

Market Impact: Liberation Day’s Ripple Effect

Trump has long warned of the risks of excessive reliance on foreign nations, a concern he voiced as early as 1988 on The Oprah Winfrey Show, where he criticized unfair trade practices impacting American workers. When elected to a position where he could make real change, he acted on these warnings, declaring a national emergency under the International Emergency Economic Powers Act of 1977 (“IEEPA”), citing “foreign trade and economic practices” as a threat to the economy. Using IEEPA, Trump imposed a 10% baseline tariff on all countries, effective April 5, 2025, and higher “reciprocal” tariffs on nations with the largest U.S. trade deficits, effective April 9, 2025. These tariffs, which challenge GATT’s most favored nation (“MFN”) principle by varying rates across countries, aim to reduce dependency, strengthen America’s manufacturing base, and pursue fairer trade—stopping short of full autarky but prioritizing economic sovereignty.

The tariffs stemming from April 2nd’s Liberation Day triggered significant market volatility, with the S&P 500 experiencing substantial declines. Markets took a turn for the worst when Trump announced what analysts called “Washington’s steepest trade barriers in more than 100 years,” leading to a massive $2.4 trillion loss in S&P 500 companies’ stock market value—the biggest one-day loss since the early days of the COVID-19 pandemic in March 2020. This market sell off indicates just how reliant some American corporation have become on the global supply chain. But this reliance didn’t happen overnight, it started in the 1990s following the establishment of the World Trade Organization (“WTO) after the General Agreement on Tariffs and Trade (“GATT”). An agreement that cut the knees out from under the manufacturing base in America, i.e., the Middle Class. But hey, we got cheap goods and more choices.

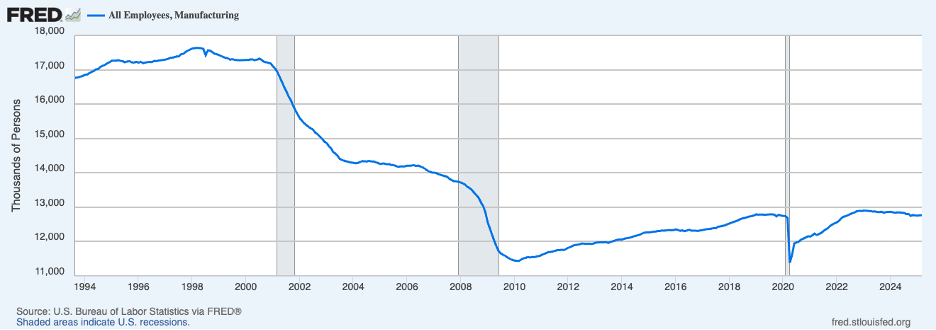

Unintended consequences of GATT

The shift toward globalization in the 1990s devastated America’s manufacturing base. As trade barriers fell, businesses made profit-maximizing decisions by seeking lower-cost production overseas, dramatically diminishing America’s domestic manufacturing capacity. This economic transformation followed a perfectly rational business logic—as Charlie Munger astutely observed, “Show me the incentive and I’ll show you the outcome.” American corporations, incentivized by higher profits through reduced production costs—particularly the wages paid to American workers—systematically offshored manufacturing operations, resulting in a profound erosion of the middle class.

What’s particularly troubling is that this degradation was anticipated during GATT negotiations. Economic officials entrusted with protecting public interests knowingly made decisions that would leave ordinary citizens worse off. Politicians duped their constituent with the idea of lower cost goods and more choice, without making them aware of the long-term consequences, i.e., economic stability through labor force participation. Sir James Goldsmith presciently identified these dangers in his 1994 interview with Charlie Rose, characterizing globalization as a “trap.” He specifically warned against the formation of the World Trade Organization (WTO), predicting it would hollow out the Western middle class and economic security. Goldsmith explicitly cautioned that this path would ultimately lead to societal breakdown, as corporations effectively declared their domestic workforces too expensive, shifting manufacturing abroad while continuing to import finished goods back into domestic markets.

The consequences of offshoring manufacturing extend far beyond immediate job losses. When production capabilities leave a nation, they take with them not just employment opportunities but also technical expertise, innovation ecosystems, and economic resilience. While globalization advocates point to consumer benefits like lower prices and greater product variety, these advantages came with substantial hidden costs that weren’t adequately considered in the economic calculus—costs that manifested in hollowed-out communities, stagnant wages, increased inequality, and diminished economic security for millions of American families.

Globalization in moderation is fine, but over dependency can lead to issues

Globalization in moderation can be beneficial, but over-dependency creates significant risks, particularly with respect to national security. Milton Friedman’s famous pencil analogy—based on Leonard Read’s essay—illustrates global trade’s efficiency: “No single person can make a pencil,” he explained, as it requires wood, graphite, rubber, and metals from around the world, all coordinated without central planning. Yet, this same interconnectedness exposes and reinforces critical vulnerabilities like codependency issues or over specialization. Just as a chef with only a knife struggles to cook a full meal, a nation overly reliant on global trade risks losing self-sufficiency in essential sectors like semiconductors, power infrastructure, and defense manufacturing. These vulnerabilities, exposed by GATT’s legacy, are what Trump’s tariffs aim to address—balancing the benefits of trade with the need to safeguard America’s economic security and independence. I would be remiss if I didn’t mention that the elimination of income tax could help absorb these transition costs, but that’s a topic we will save for another day.

Bitcoin as a Safe Haven Asset

Interestingly, while the S&P 500 took a continued nose during the week’s market volatility, Bitcoin demonstrated relative resilience. Although Bitcoin prices had declined since year’s end from 100k highs to the mid-80,000s the price remains above all time highs, and its performance during the tariff tantrum demonstrates its grow reliance as a risk off asset. The resilience could be attributed to Bitcoins lack of ties to reliance on global trade and it’s immutability, no one was rehypothecating bitcoin to finance the American production overseas.

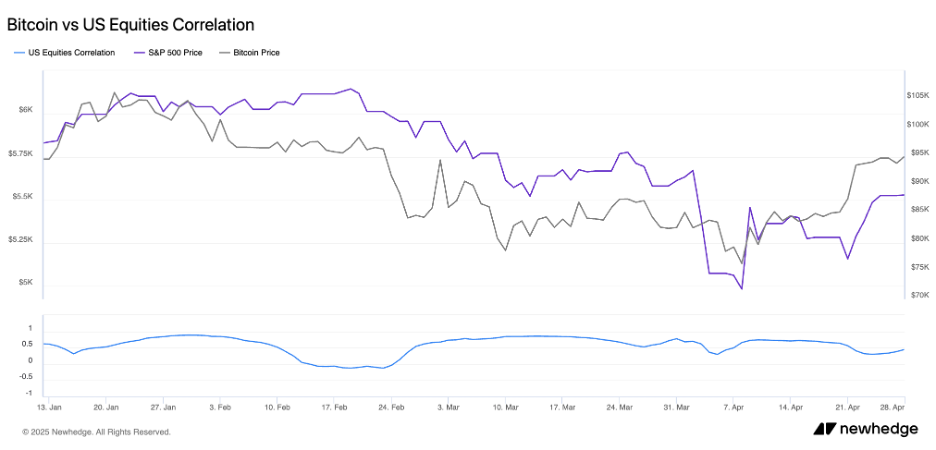

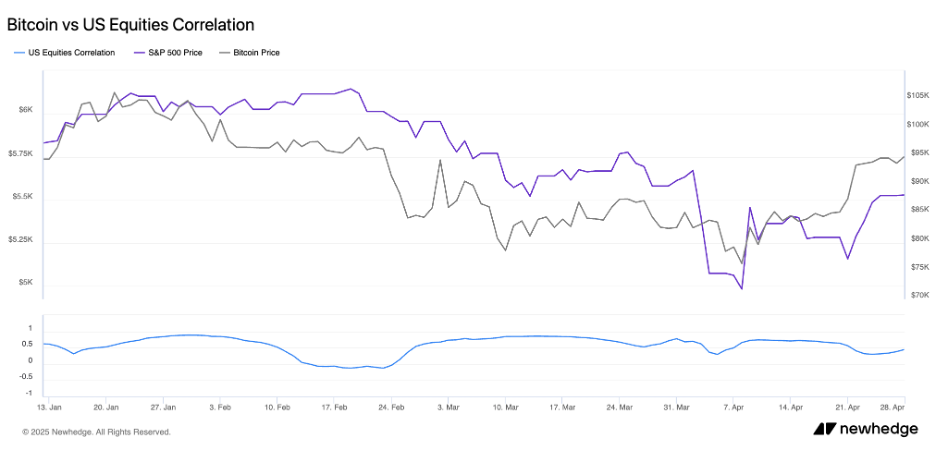

When Trump announced the 90-day pause on tariffs on April 9, Bitcoin surged above $81,000, posting a 5.5% gain over 24 hours. Other cryptocurrencies rallied even more significantly, with XRP, Solana’s SOL, and others posting over 10% gains. While the S&P 500 and traditional assets also seemed to make up some ground. Since Liberation day, the SP500 has decline rough 2% while Bitcoin has seen an increase over 12%. We don’t like to forecast based on short term movements, but we must call attention to the disparity between the price movements here. Because it demonstrate Bitcoin’s potential as an uncorrelated risk-off asset similar to gold—what we like tocall “digital real estate.” This performance suggests that some investors view Bitcoin as a potential hedge against uncertainty in traditional markets.

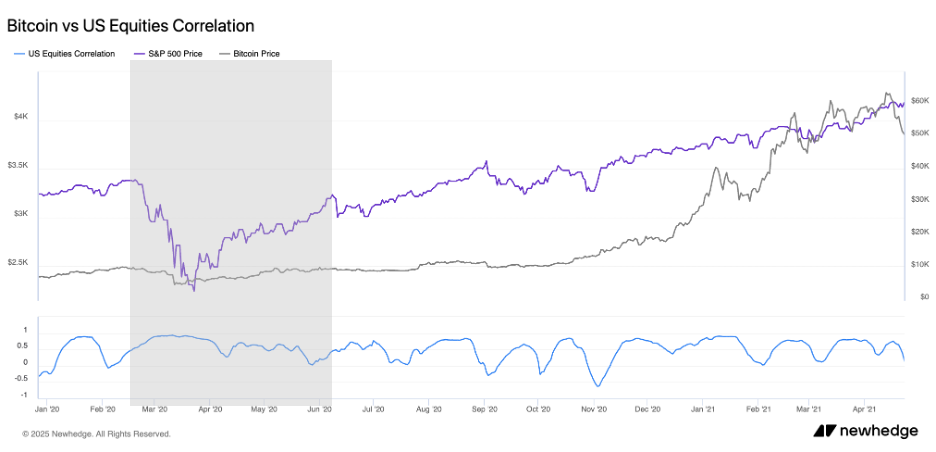

Lastly, Bitcoin has demonstrated remarkable resilience through periods of extreme volatility. The COVID-19 selloff in 2020 showcased Bitcoin’s initial correlation with traditional markets during acute crisis, followed by a decoupling as it recovered more dramatically. While Bitcoin’s price fluctuations typically exceed the magnitude seen in equity markets, its correlation patterns during systemic market stress deserve particular attention, especially when monetary policy interventions serve as a primary catalyst for market instability. This relationship offers potential strategic advantages for investors seeking alternative stores of value during periods of economic uncertainty.

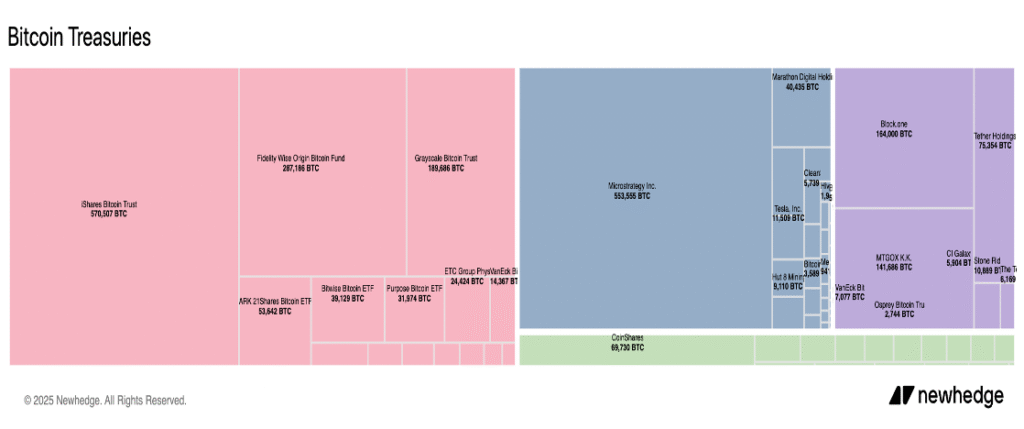

In terms of adoption, it appears that it’s gaining favor among institutions and corporations as a treasury asset and hedge against monetary policy. For example, institutional adoption has fundamentally altered Bitcoin’s market dynamics, with firms like MicroStrategy, BlackRock, and Fidelity allocating significant capital to Bitcoin holdings.

Direct Action Against Crypto No More: The Evolving Regulatory Landscape

DOJ Stepping Back

The Department of Justice disbanded its National Cryptocurrency Enforcement Team (“NCET”) in April 2025, redirecting resources toward combating violent crime—human trafficking, drug distribution, and arms dealing. According to Deputy Attorney General Todd Blanche’s memo, the DOJ will now take a “decentralized approach for digital asset cases,” explicitly stating that “the Department of Justice is not a digital assets regulator.”

Before mainstream media frames this as dangerous for investors, let me clarify: this isn’t open season on crypto investors. The Trump Administration is prioritizing innovation over enforcement, not abandoning protections. Fraud remains fraud, and bad actors will still face accountability through civil or criminal courts. This shift creates opportunities for plaintiffs’ attorneys to establish precedent regarding acceptable market conduct. For now, it’s caveat emptor—do your own research and partner with reputable teams if you want capital operating in the digital asset space.

Wild West Warnings – I’m your Huckleberry

Importantly, this shift also isn’t a signal that the digital asset space is all rainbows and sunshine. Far from it. The cryptocurrency landscape remains the wild west, particularly concerning as AI large language models enable individuals with malicious intent to operate with enhanced capabilities. What was once a 100 IQ person with a grudge can transform into a 120 IQ Batman-like villain—concerning to say the least. This heightened risk makes it imperative for those venturing into this frontier to partner with experts who understand the regulatory landscape and can navigate its complexities strategically.

The Hawk Tuah Coin: Lesson, Learned

The “Hawk Tuah” coin saga is a cautionary tale for cryptocurrency investors, highlighting the volatility and legal risks tied to meme coins. Inspired by viral social media star Hailey Welch, the $HAWK token surged to a $490 million market cap shortly after its December 2024 launch, only to plummet 90% within hours. This dramatic collapse sparked a class-action lawsuit, Albouni et al. v. Schultz et al., Case No. 1:24-cv-08650, filed by investors against the coin’s creators—though notably not Welch herself. While the U.S. Securities and Exchange Commission (SEC) recently decided not to pursue an investigation into Welch, the civil litigation remains active, underscoring that legal consequences persist even without federal enforcement.

The lawsuit hinges on allegations of securities fraud, specifically whether the $HAWK token qualifies as a security under federal law and if its sale without registration violated regulations. The plaintiffs claim the token’s promotion created an expectation of profits tied to the efforts of the project team, potentially meeting the Howey test for a security. The outcome will depend on evidence uncovered in discovery and how the court interprets securities laws.

For now, the litigation continues unabated by the SEC’s decision. The case could stretch over months or years, heading toward trial or a settlement. Time will reveal whether investors recover losses or if the defendants successfully defend their actions.

New Rules of Engagement

This transition from government prosecution to civil litigation creates a dangerous gray area for everyday investors. With regulatory watchdogs stepping back, predatory projects are stepping forward, making thorough research more critical than ever. Investors must either develop expertise in evaluating token fundamentals, team credentials, and security measures, or work with a team that understand both the technology and legal frameworks.

Remember: reduced enforcement doesn’t mean reduced risk—it simply transfers the due diligence burden from regulators to you. In this new environment, protection isn’t coming from Washington but from your own research or trusted advisors who can help you navigate the legal intricacies of this rapidly evolving space.

Bitcoin, Utility Tokens, and Stablecoins: Market Evolution

The digital asset landscape continues to mature beyond the speculative and high-risk classification that’s plagued its advancement over the past decade toward fundamental value creation. Bitcoin’s emergence as digital real estate or gold rather provides portfolio diversification with uncorrelated returns during market stress, despite quantum challenges requiring vigilance. Meanwhile, utility tokens with genuine use cases are displacing pure speculation, warranting CHPG’s disciplined analytical framework. Stablecoins represent blockchain’s most immediate practical application, potentially reinforcing dollar hegemony while democratizing financial access. As regulatory frameworks solidify and institutional participation deepens, these three asset classes are establishing distinct but complementary roles in the global financial system—requiring investors to develop nuanced strategies tailored to each segment’s unique risk-return profile.

Bitcoin: Digital Real Estate

Bitcoin has demonstrated impressive resilience during recent market turbulence, particularly following the “Liberation Day” tariff announcements. This decoupling from traditional asset classes suggests Bitcoin is maturing into a legitimate store of value—functioning more like digital real estate or gold than a speculative technology investment. Institutional adoption has fundamentally altered Bitcoin’s market dynamics, with firms like MicroStrategy, BlackRock, and Fidelity allocating significant capital to Bitcoin holdings.

The emergence of decentralized finance has created additional utility for Bitcoin holders, enabling them to collateralize their assets for reinvestment at competitive rates. This mirrors traditional real estate development financing models, where existing assets secure capital for new ventures. With proper risk management strategies, as implemented by CHPG, Bitcoin holders can leverage their positions to pursue opportunities in emerging sectors like AI and SMBs, or further diversify within digital assets without liquidating their core Bitcoin holdings.

This institutional shift has driven a more sophisticated valuation approach, moving beyond speculation toward fundamentals-based analysis. As global monetary policies continue to create uncertainty, Bitcoin’s fixed supply and decentralized structure position it as a potential hedge against inflation and currency debasement. The Strategic Bitcoin Reserve initiative from the current administration further legitimizes Bitcoin as a national asset class, potentially accelerating institutional adoption.

Quantum Risk Spurs Bitcoin Improvement Proposal

It would be remiss to not to address quantum computing as a potential risk to the Bitcoin protocol. While Bitcoin’s decentralized nature is a strength, implementing network upgrades at its current scale presents some challenges—comparable to changing course an aircraft carrier on collision course. Fortunately, we’re in the early stages and have time and space to turn the ship. Industry discussions include an upcoming Bitcoin Improvement Proposal that would implement quantum-resistant private key algorithms. Given these implications, CHPG continues to monitor developments while maintaining hedging strategies through put collars and VIX options. The latter of which has proven valuable during recent market volatility, while the former represents a necessary insurance cost to protect investor capital.

Utility Tokens: Value-Driven Analysis

As the market matures beyond meme coin speculation, investment focus is shifting to utility tokens with genuine value propositions. These tokens underpin functional blockchain ecosystems, providing governance rights, access to services, or facilitating network operations. This shift necessitates a more rigorous analytical framework, similar to traditional securities analysis but adapted to blockchain economics.

CHPG’s five-pillar framework evaluates utility tokens based on: 1) adoption; 2) tokenomics; 3) use cases; 4) leadership; and 5) risk profile. This approach prioritizes long-term value creation over short-term price speculation. Projects demonstrating sustainable tokenomics, growing user bases, and clear utility cases are increasingly drawing institutional capital, particularly as regulatory clarity improves.

Stablecoins: Redefining Financial Infrastructure

Stablecoins represent one of blockchain technology’s most immediate and practical applications, providing 24/7/365 access to dollar-denominated liquidity without traditional banking limitations. They offer three key benefits: 1) dramatic reduction in transaction costs and settlement times compared to legacy systems, 2) protection against local currency volatility in emerging markets, and 3) creation of programmable money for more efficient capital markets.

For those unfamiliar with stablecoins, let’s break it down barney style. Stablecoins are digital tokens designed to maintain a stable value by being pegged to an external asset—typically the US dollar. Major stablecoins like USDC and USDT are backed by reserves of highly liquid assets such as US Treasury bills, cash, and commercial paper. Unlike traditional fiat currency, stablecoins are programmable digital assets that utilize blockchain technology and smart contracts to facilitate transactions while maintaining compliance with KYC/AML regulations. Their key advantage is efficiency: stablecoin transfers, settling in minutes rather than being subject to traditional banking limitations like 24-hour wire transfer delays or 3-5 business day ACH processing times. This creates a more accessible, efficient system for cross-border payments and digital commerce without sacrificing the stability that users expect from dollar-denominated assets.

The stablecoin landscape is evolving rapidly with both private issuers and traditional banks entering the market. The Federal Reserve notes that stablecoins’ primary current use is facilitating cryptocurrency trading on public blockchains, but their potential extends far beyond crypto markets. As regulatory frameworks like the GENIUS Act and STABLE Act advance toward implementation, we expect to see regulated financial institutions launching their own stablecoin products. This could reinforce dollar hegemony in the global financial system while simultaneously providing greater financial inclusion and efficiency.

The Risks That Lie Ahead

Though crypto markets appear to be stabilizing under the current administration’s Main Street-first policies, we remain vigilant about significant risks on the horizon. At CHPG, we’ve adopted a pragmatic philosophy: identify promising innovations, then rigorously assess their potential threats. As Andy Grove, former Intel CEO, famously cautioned: “Only the paranoid survive.” This strategic vigilance isn’t pessimism—it’s prudent investing in an inherently volatile space.

We have identified three primary concerns that demand attention in the coming years. First, we face increasingly sophisticated cybersecurity threats targeting critical infrastructure and financial systems. Second, we must acknowledge the fragility of power systems upon which all Americans ultimately depend. Third, we must recognize that social engineering attacks are becoming more prevalent. This section examines each of these threats and outlines CHPG’s strategic response to navigate these challenges while protecting client assets.

Cybersecurity Threats: the Invisible Battlefield

Recent cyber incidents targeting American infrastructure are significantly underreported to the public, creating a dangerous illusion of security. While the 2022 Strengthening American Cybersecurity Act requires critical infrastructure to report breaches to CISA, it doesn’t mandate customer notification—producing a critical information gap between what officials know and what citizens are told. In recent months, threat actors have successfully targeted statewide 911 call centers, water facilities, telecommunications networks, and government systems, revealing a systematic pattern of attacks against fundamental services.

The severity of these threats was highlighted when U.S. National Security Advisor Jake Sullivan reportedly warned telecommunications executives that “Chinese hackers had gained the ability to shut down dozens of U.S. ports, power grids and other infrastructure targets at will.” This combination of limited public awareness and increasingly sophisticated attack vectors creates profound vulnerabilities throughout our digital financial ecosystem, including cryptocurrency markets, as well as broader societal infrastructure.

Small to Medium Sized Businesses: Low Hanging Fruit

Small to Medium-Sized Businesses (“SMBs”) face disproportionately elevated risk in this threat landscape. As sophisticated attackers encounter hardened defenses around critical infrastructure due to federal legislation and heightened scrutiny, they increasingly pivot toward softer targets. SMBs represent optimal opportunities for malicious actors—offering substantial potential rewards with minimal risk exposure and detection probability.

While NIST frameworks and recent FTC enforcement actions establish baseline protection standards, these measures primarily address known threats rather than providing robust, adaptive security postures. In short, they favor compliance over real protection. Specifically, most SMBs lack the resources for informed threat detection and proactive defense, making them ideal targets in a risk-reward calculation that heavily favors attackers.

Though CHPG isn’t positioned to develop comprehensive cybersecurity tools for the SMB sector, we remain committed to raising awareness about these risks and providing guidance on fundamental protection strategies. By sharing knowledge and best practices, we hope to mitigate concerns regarding ransomware attacks and data breaches that increasingly threaten businesses operating in the digital economy.

Grid Vulnerabilities

America’s power infrastructure represents a critical vulnerability with profound implications for the entire financial system, as well as society at large. The U.S. power grid has become increasingly dependent on foreign-manufactured components, creating dangerous national security exposures. Federal investigations have identified concerning hardware vulnerabilities in imported transformers that could allow remote deactivation, while congressional testimony has revealed that hundreds of ultra-high-voltage transformers potentially equipped with hardware backdoors are currently operating at critical points in the U.S. power grid. These vulnerabilities extend beyond transformers to other essential grid components like inverters, of which the U.S. has imported more than 170 million since 2002.

Financial Sector’s Existential Risk

For the financial sector, which depends entirely on reliable electricity for everything from data centers to payment processing systems, this grid vulnerability creates existential risk. A coordinated attack on power infrastructure would immediately impact market operations, transaction settlement, banking access, and security systems. Major financial institutions have backup power systems, but these are designed for short-term outages, not prolonged disruptions. Extended power failures would systematically degrade financial operations, potentially triggering liquidity crises, settlement failures, and service disruptions that could rapidly cascade through interconnected global markets.

Blockchain’s Decentralized Resilience

In contrast, Blockchain’s decentralized nature starkly contrasts with the centralized U.S. financial system’s vulnerability to mass power outages. Traditional finance relies on concentrated data centers and grid-dependent infrastructure, requiring immense power to sustain operations. A prolonged outage would cripple banking, trading, and payment systems, as backup generators at major institutions are built for short-term disruptions, not sustained grid failure. Conversely, blockchains like Bitcoin thrive on distributed nodes, where a single consumer with minimal technology—a laptop, solar panel, and satellite internet—can maintain the ledger. Even with miners offline, the Bitcoin network persists as long as one node remains active, preserving transaction history and enabling peer-to-peer transfers once miners resume. This resilience empowers individuals, ensuring financial access while centralized systems falter.

Social Engineering Attacks

“The blockchain industry is now grappling with operational security failures—where people, not code, are the primary target.”

Trail Bits

The financial sector faces increasingly sophisticated social engineering attacks that bypass technical security measures by targeting human psychology. Law enforcement has warned that state-sponsored actors are conducting highly tailored, difficult-to-detect social engineering campaigns against financial institutions, with tactics so sophisticated that even cybersecurity experts remain vulnerable. These attacks evolve beyond traditional phishing emails, with threat actors establishing convincing personas through professional networks, conducting extensive research on targets, and deploying custom malware disguised as legitimate business applications.

Financial institutions of all sizes should prioritize human-centered security awareness. Warning signs include unexpected job offers with unusually high compensation, unsolicited investment opportunities, requests to use non-standard software for routine tasks, or pressure to move conversations to different messaging platforms. Organizations should implement multi-factor authentication, regularly train employees on evolving social engineering tactics, verify contacts through independent channels, and maintain strict controls on remote access to critical systems. As these attacks become more prevalent and sophisticated, constant vigilance and systematic verification procedures represent the most effective defense against what has become the primary vector for financial theft in the digital age.

Next steps for CHPG

CHPG is in the business of selling security; securing US citizens’ futures in the digital economy. In response to the threats outlined above, we maintain rigorous risk management protocols while staying informed on emerging dangers in this innovative landscape. We’ve also added a member to the team who will explore opportunities in physical, cyber, and personal security—a natural extension given our military backgrounds that perfectly aligns with our overall thesis. With a reordering of the monetary system already underway, we’re strategically entrenching ourselves in the future industries that AI, blockchain, and quantum computing are set to revolutionize. Make no mistake—this transformation will be one hell of a ride over the next several years.

America is charting a new course back to fundamental roots where integrity, authenticity, and kindness ring true once again. We’re witnessing a shift toward real value, where production, manufacturing, and innovation will reshape our world. Within the coming months, we’ll be conducting a private placement for our Digital Asset & AI Innovation LP, exclusively for accredited investors who share our vision. To be clear, Bitcoin and cryptocurrencies aren’t here to compete with financial institutions or divert investor funds—rather, we’re working to upgrade the current financial system to enhance resilience and expand participation.

As a continued effort, we’re interfacing with SMBs to help them prepare for emerging risks that could impact their operations. This digital revolution, for all its benefits, comes with significant privacy concerns that must be addressed before they spiral into dystopian scenarios where social credit scores determine financial freedom—hyperbolic perhaps, but you understand the stakes. If you’re interested in collaborating, learning more about our undertaking, or even if you disagree with everything in this article, please reach out. Our mission is to ensure no one gets left behind, and we welcome any opportunity to learn and reorient our approach through substantive dialogue with diverse perspectives.

Disclaimer: The information provided in this article is for informational and educational purposes only and should not be construed as financial, investment, legal, or tax advice. This article and any and all other content published to this platform is not an offer to sell or a solicitation of an offer to buy any securities, cryptocurrencies, or other financial instruments. All content, opinions, and analyses presented reflect the views of Commanding Heights Pioneer Group, LLC (“CHPG”) based on market research and analysis. While CHPG strives for accuracy in its analysis, markets and humans are complex and dynamic – we acknowledge that our views may evolve as new information emerges, and we learn from both our successes and misjudgments. Most importantly, past performance is not indicative of future results. Additionally, while we use AI tools to support our research and drafting processes, all outputs are subject to rigorous human oversight and review to ensure accuracy, thoughtful analysis, and full compliance with our ethical standards. CHPG encourages readers to think critically and form their own conclusions based on multiple information sources. For further information, please see the news and insights sections in our terms of use located on our website www.commandingheightspioneergroup.com/terms-of-use/.