As the Trump Administration prepares to take office in January 2025, the crypto market landscape appears poised for significant changes. With potential pro-crypto leadership being discussed for key positions at the SEC and Treasury, combined with growing bipartisan Congressional support, regulatory clarity seems to be on the horizon. However, this transition won’t happen overnight, and like previous market cycles (Bitcoin historically operates on 4-year cycles tied to its halving events), we can expect some volatility along the way.

The economic landscape remains complex, particularly following the March 2023 liquidity injection after Signature Bank’s collapse. While traditional economic indicators suggested a recession should have begun then, various market interventions – like the Federal Reserve’s Bank Term Funding Program (BTFP) providing up to $25 billion in loans to stabilize regional banks, and the FDIC’s full deposit guarantee for Silicon Valley Bank customers beyond the standard $250,000 limit – have delayed this outcome. Though crypto as an asset class hasn’t experienced a true recession (except for Bitcoin’s launch in the wake of the 2009 financial crisis), we’ll explore why the sector might perform better than expected, particularly Bitcoin.

BLUF (Bottom Line Up Front)

- Trump’s anticipated 2025 return and new SEC leadership signal a major pro-crypto regulatory shift, supported by the BITCOIN Act and Lummis-Gillibrand Act aimed at comprehensive crypto regulation.

- Judge Failla’s denial of Coinbase’s motion to dismiss overlooked crypto’s transformative impact, warranting Major Questions Doctrine scrutiny.

- Despite economic warning signs in real estate and banking sectors, AI technology’s integration could help avoid a severe downturn by driving unprecedented productivity gains across industries.

- Bitcoin and crypto assets may thrive during economic challenges as companies accelerate tech adoption and seek hedges against potential inflation from monetary policy responses, though short term pain is expected.

- CHPG’s portfolio has achieved nearly 50% year-to-date gains through strategic AI investments and protective options strategies, positioning for both market stress and recovery.

Regulatory Landscape

The regulatory environment for cryptocurrencies appears to be at a pivotal turning point as we approach 2025. After years of what many viewed as hostile oversight, particularly under SEC Chair Gary Gensler’s administration, the crypto industry stands to benefit from significant leadership changes and evolving political attitudes.

The crypto industry has faced significant regulatory headwinds over the past four years. Many critics have dismissed the entire sector based on high-profile failures like FTX, Celsius, BlockFi, and Binance’s legal issues. However, this oversimplification has enabled what many view as regulatory overreach by the SEC, preventing many protocols from demonstrating their actual value propositions. This regulatory pressure has created a unique investment opportunity, as many promising protocols are trading at significant discounts to their potential value.

BITCOIN Act of 2024

Senator Cynthia Lummis of Wyoming has emerged as a leading force in crypto legislation through two groundbreaking proposals. The BITCOIN Act of 2024 proposes establishing a strategic Bitcoin reserve, authorizing the U.S. Treasury to acquire up to 1 million Bitcoins over five years (200,000 annually) using Federal Reserve surplus returns and revalued gold certificates. These Bitcoins would be held in trust for at least 20 years, aiming to strengthen the dollar and position the U.S. as a leader in the evolving global financial landscape.

Lummis-Gillibrand Responsible Financial Innovation Act

Complementing this, the Lummis-Gillibrand Responsible Financial Innovation Act (RFIA) offers a comprehensive regulatory framework for the entire digital asset ecosystem. The RFIA clarifies the jurisdictional boundaries between the SEC and CFTC, establishes consumer protection standards, provides digital asset taxation guidelines, and sets requirements for depository institutions issuing payment stablecoins. While the BITCOIN Act focuses specifically on establishing Bitcoin as a strategic reserve asset, the RFIA addresses the broader regulatory landscape needed for the entire digital asset market to thrive.

Trump’s recent statements at the Bitcoin conference, where he distinguished Bitcoin from other cryptocurrencies, align with these legislative efforts. This nuanced understanding, combined with growing bipartisan support for crypto regulation, suggests a potential shift from regulatory uncertainty to clarity. Even if these specific bills don’t pass in their current form, they represent significant progress in the dialogue around integrating digital assets into the U.S. financial system.

SEC Leadership Changes Signal New Direction

The announced departure of SEC Commissioners Gensler and Lizarraga marks another potential catalyst for the crypto industry. Their replacements under the new administration will likely take a more constructive approach to regulation, potentially leading to the dismissal or favorable settlement of pending enforcement actions and the withdrawal of numerous Wells notices. This regulatory reset, combined with the proposed comprehensive legislative frameworks, suggests that the crypto industry may finally receive the regulatory clarity it needs to flourish while maintaining appropriate consumer protections.

Legal Framework Evolution

Recent Supreme Court decisions have significantly altered the regulatory landscape for cryptocurrencies by redefining the scope of federal agency power. The most impactful of these, West Virginia v. EPA, invoked the Major Questions doctrine, requiring federal agencies to have explicit Congressional authorization before regulating issues of major “economic and political significance.”

Crypto’s Underlying Value Proposition Should Invoke the Major Questions Doctrine

SDNY Judge Failla’s recent ruling on Coin Base’s Motion to Dismiss, while carefully reasoned, acknowledges the crypto industry’s scale but fails to recognize its transformative potential. In November 2024, the global cryptocurrency market capitalization reached $3.48 trillion, surpassing France’s projected GDP of $3.17 trillion for the same year. But it’s not the just the size of the market that makes cryptocurrency regulation a “major question” – it is blockchain’s potential to fundamentally reshape America’s financial system. A transformation so consequential that Congress would never have delegated such broad regulatory authority to an agency without explicit direction.

Her reasoning that the EPA’s potential energy market restructuring was more significant fails to recognize that blockchain technology is poised to revolutionize not just how Americans invest, but how they bank, transfer value, and participate in the financial system. Moreover, her attempt to distinguish this case from Nebraska based purely on numerical comparisons overlooks how blockchain’s systemic importance to America’s financial future demands the same careful consideration that the Court gave to energy markets and student loan forgiveness.

Weakening Power of the Administrative State

This shift in administrative law, combined with the Lucia v. SEC decision regarding Administrative Law Judge appointments and Jarkesy v. SEC challenging the SEC’s use of in-house adjudications, suggests a rebalancing of power between executive agencies and Congress. For the crypto industry, this means the SEC may face increased scrutiny when attempting to regulate digital assets without clear Congressional direction. As cryptocurrencies undoubtedly qualify as a “major question” given their economic significance and broad impact, the SEC’s authority to unilaterally classify most tokens as securities becomes legally questionable. This legal framework supports the need for comprehensive legislation like the RFIA and BITCOIN Act, rather than relying on agency interpretation of decades-old securities laws.

Economic Outlook

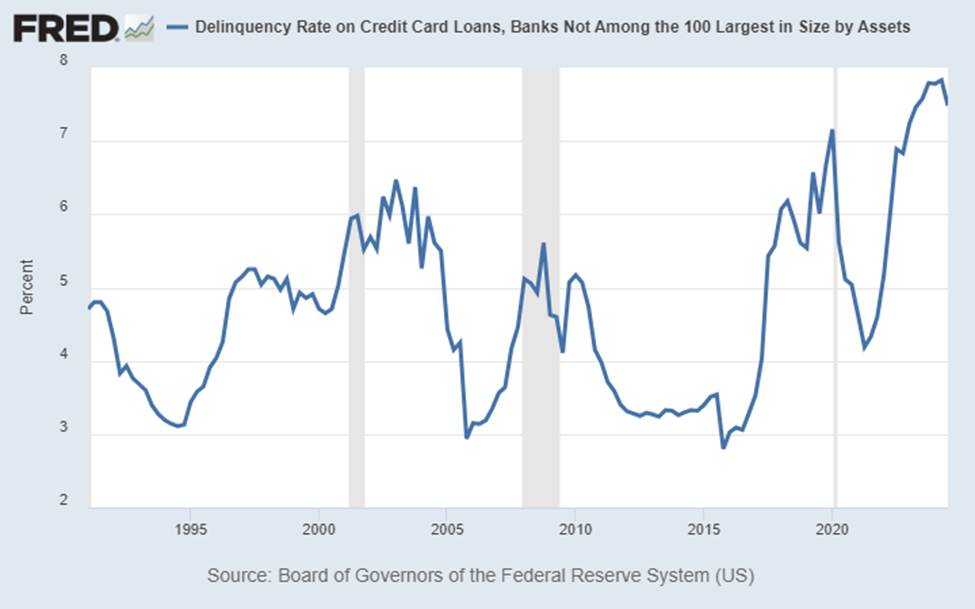

Economic indicators across multiple sectors paint a concerning picture of potential market stress ahead. Commercial real estate faces nearly $650 billion in unrealized losses and rising delinquency rates, while consumer credit stress is mounting, particularly among regional banks, where credit card delinquency rates approach 8%. However, CHPG’s portfolio is strategically positioned to benefit from these challenging conditions. Historical patterns show that during economic downturns, companies aggressively adopt cost-saving technologies to maintain productivity while reducing expenses. Our investments in blockchain and AI technologies mirror successful strategies from previous recessions, like Amazon’s AWS expansion during the 2008 crisis. Moreover, the unprecedented productivity gains from artificial intelligence could potentially help markets avoid a severe downturn, creating a unique scenario where technology might actually prevent or significantly mitigate a traditional recession.

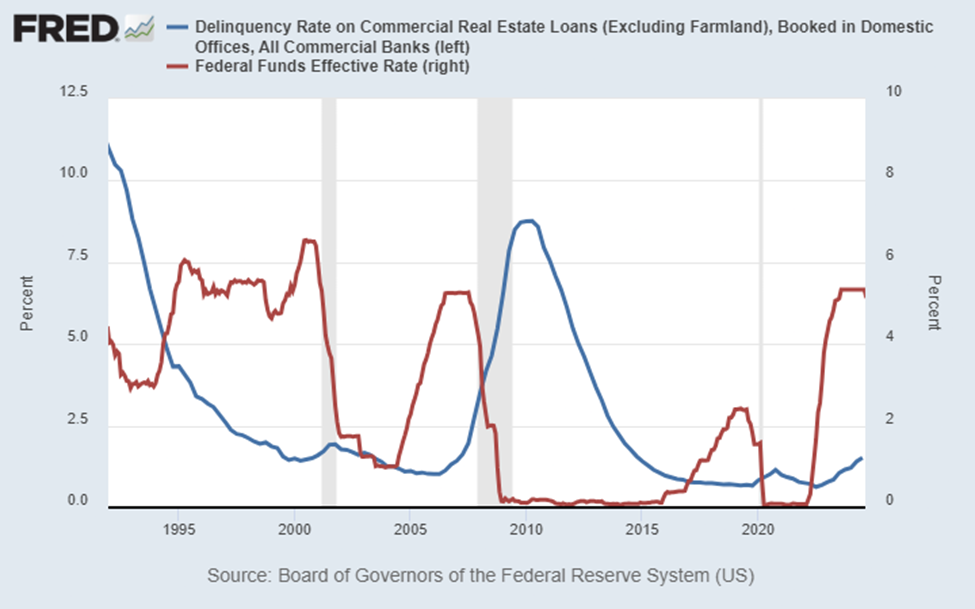

Commercial Real Estate Delinquency and Federal Funds Rate

We can see delinquency rates beginning to tick upward, currently around 1.5%, while the federal funds rate has risen sharply to about 5%. This pattern is particularly concerning when we compare it to historical trends. During the 2008 financial crisis, delinquency rates peaked at nearly 8.5% when interest rates were much lower. With rates now significantly higher, the potential for increased delinquencies becomes more pronounced as property owners face refinancing challenges.

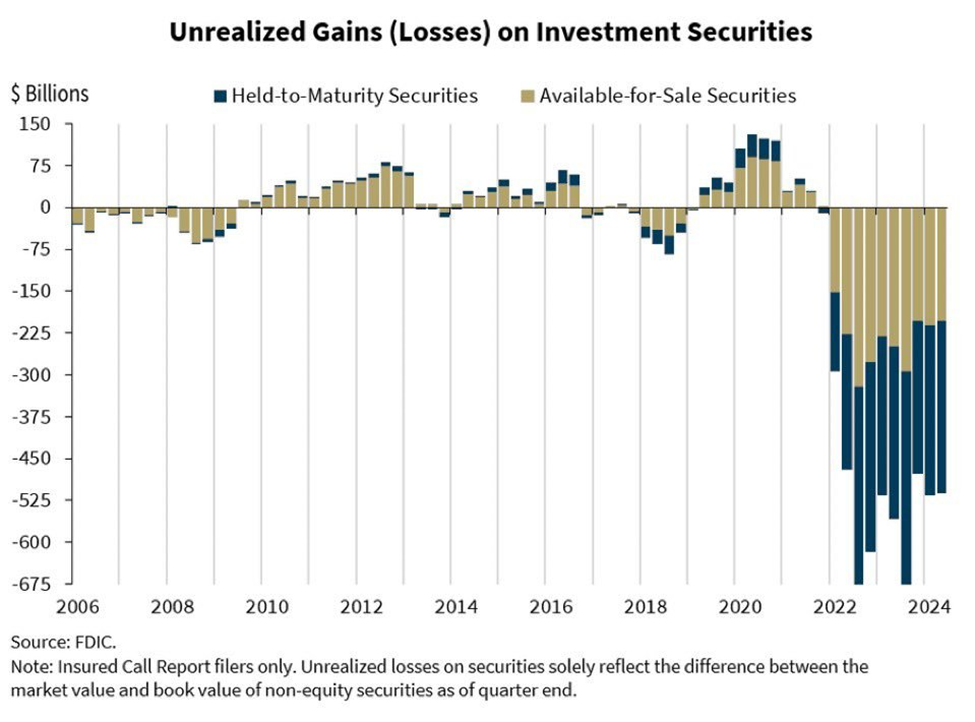

Bank Securities Portfolio Losses

Since 2022, banks have faced approximately $650 billion in unrealized losses on their securities portfolios, primarily due to rising interest rates devaluing existing lower-yield bonds. These “paper losses” constrain banks’ ability to sell assets or adjust portfolios without realizing significant losses, marking the largest unrealized loss position in recent history. While banks can hold securities to maturity to avoid recognizing losses, this strategy limits liquidity and operational flexibility, creating additional constraints for the financial sector.

In June 2023, the FDIC issued the Policy Statement on Prudent Commercial Real Estate Loan Accommodations and Workouts, encouraging lenders to work with borrowers by extending loan maturities and modifying terms to avoid immediate loss recognition. Often referred to as “pretend and extend,” this guidance provides short-term stability for the market by deferring financial stress. However, critics argue that this approach delays the inevitable realization of losses, potentially prolonging market imbalances and creating an extended period of uncertainty in both the banking and commercial real estate sectors.

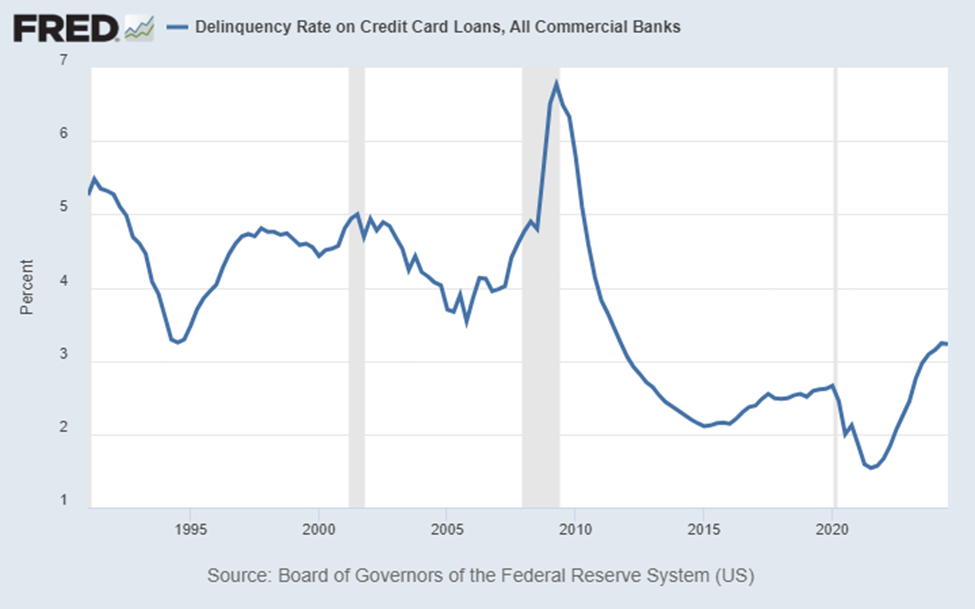

All Commercial Banks’ Credit Card Delinquencies

Credit card delinquency rates across all commercial banks indicate a steady increase since the pandemic lows, now approaching 3%. While this rise is concerning, it’s worth noting that we’re still below the peak levels seen during the 2008-2010 period when delinquencies reached nearly 6.5%. However, the trajectory of the increase, particularly its steepness since 2022, suggests growing consumer financial stress.

Smaller Banks’ Credit Card Delinquencies

Smaller banks are experiencing delinquency rates approaching 8%, significantly higher than the overall average and near historical highs. This disparity between large and small banks suggests that financial stress is concentrated in regional banking sectors, potentially indicating more systemic issues in certain geographic areas or market segments. This concentration of risk in smaller institutions could have broader implications for regional economic stability.

The AI Revolution as an Economic Catalyst

The transformative potential of artificial intelligence represents perhaps the most significant productivity advancement since the internet revolution. Goldman Sachs estimates AI could add $7 trillion to global GDP over the next decade, while McKinsey suggests AI automation could deliver up to $4.4 trillion in annual value for the banking industry alone. This technological leap is already manifesting in practical applications—companies like McDonald’s are exploring AI-driven systems to enhance efficiency, with automation showing potential to significantly reduce labor costs, while Walmart’s AI inventory management systems aim to optimize stock levels and reduce out-of-stock items. When scaled across the economy, such efficiency gains could help offset traditional recessionary pressures by enabling companies to maintain profitability even in challenging conditions. Whether AI successfully prevents a significant market downturn or companies accelerate AI adoption during a recession, our portfolio’s focus on transformative technologies positions us to benefit from either scenario. The key is recognizing that unlike previous recessions, this potential downturn coincides with a technological revolution that could fundamentally alter traditional economic patterns.

Bitcoin: Short Term Pain, Long Term Gain in a Recession

While Bitcoin may initially suffer alongside traditional assets during the early stages of a recession as investors seek cash and reduce risk exposure, its fundamental properties position it for significant long-term appreciation once monetary policy responses begin. When central banks inevitably implement quantitative easing to stimulate the economy, the resulting expansion of money supply tends to devalue fiat currencies while simultaneously driving capital toward scarce assets. Bitcoin, with its mathematically fixed supply cap of 21 million coins, stands to benefit substantially from this dynamic, as its absolute scarcity makes it an attractive store of value against currency devaluation. This pattern has historically played out during previous periods of monetary expansion, suggesting that patient Bitcoin holders who weather the initial market turbulence may be rewarded as institutional capital seeks inflation-resistant assets in response to expansionary monetary policy.

What does this all mean for CHPG?

While cryptocurrencies haven’t experienced a traditional recession, the coming economic challenges could serve as a powerful catalyst for the industry. Economic downturns historically separate robust technologies from weaker alternatives, and this recession could similarly distinguish valuable blockchain protocols from speculative tokens. When faced with economic pressure, companies typically seek efficiency through technological adoption, while governments often resort to monetary expansion – both scenarios potentially benefiting our core holdings. Bitcoin, in particular, stands to gain from any inflation-inducing monetary policy, as its fixed supply makes it an effective hedge against currency devaluation.

Portfolio Protection and Growth Strategy

Our hedging approach provides multiple layers of protection while maintaining upside exposure. Through IBIT options, we’re implementing 3-month put collars to reduce downside risk. This approach not only protects capital but allows us to capitalize on market volatility by using increased option premiums to accumulate more Bitcoin during price declines. Additionally, our VIX exposure provides crucial protection against black swan events, a strategy that proved valuable during the August 2023 Japanese yen carry trade unwinding.

Strategic Technology Investments

CHPG focuses on companies and protocols leading the technological transformation seen today. In the artificial intelligence sector, we maintain strong positions in industry leaders like Palantir and Tesla. Palantir’s AI systems, which help organizations process vast amounts of data for decision-making, have secured crucial government partnerships and demonstrate increasing enterprise adoption. Tesla’s advantage extends beyond electric vehicles – their autonomous driving program has accumulated billions of miles of real-world data, creating an unmatched dataset for AI development, while their Optimus robot project shows promising advancement in physical automation.

Looking Ahead

With our portfolio up nearly 50% year-to-date, our strategy of combining defensive positioning with exposure to transformative technologies has proven effective. Our utility-based analysis helps identify blockchain protocols most likely to see institutional adoption, while our AI equity positions target companies with sustainable competitive advantages. As economic pressures potentially accelerate technological adoption, we remain well-positioned to benefit from both market stress and the eventual recovery. While near-term volatility is likely, our hedging strategies allow us to view market declines as opportunities to accumulate higher-quality assets at better prices.