Economic Crosscurrents: Job Market Reality, Inflation Impact, and Bitcoin’s Rising Role

At Commanding Heights Pioneer Group (“CHPG”) we’re a forward-thinking company focused on entrenching and enhancing our presence in the Fourth Industrial Revolution. The central issues facing investors today—monetary debasement, the unrealized potential of blockchain technologies, and the transformative power of artificial intelligence (“AI”)—are reshaping the global economy. We believe Bitcoin will become the world’s primary medium of exchange, with blockchain infrastructure supporting this transformation, and AI driving the innovation behind it all.

We speak the truth as we see it and reject the corporate doublespeak that dominates much of today’s business world. At CHPG, we value authenticity and objectivity—we welcome your ideas, insights, and feedback. We’re not claiming to know it all. On the contrary, we believe that we can better understand the world we’re investing in through dialogue and collaboration. So, whether you’d like to chat over coffee or jump on a call, we’re ready to hear what you have to say.

The Bottom Line Up Front (the “BLUF”)

-

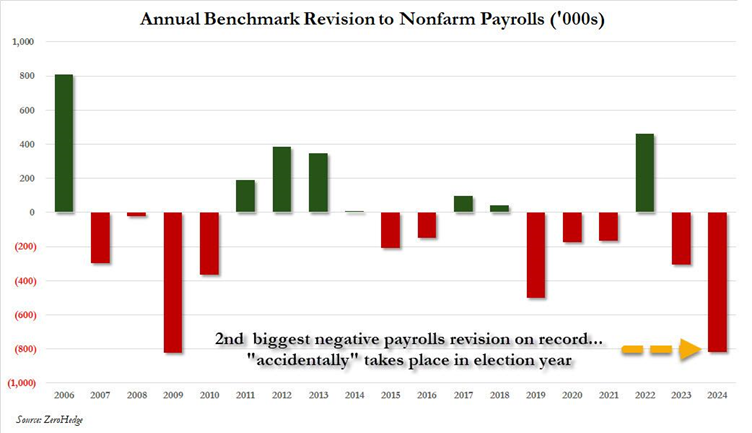

- Job Market Overstated: Recent revisions by the BLS reveal a downward adjustment of 818,000 jobs from March 2023 to March 2024, calling into question the strength of the reported job market.

-

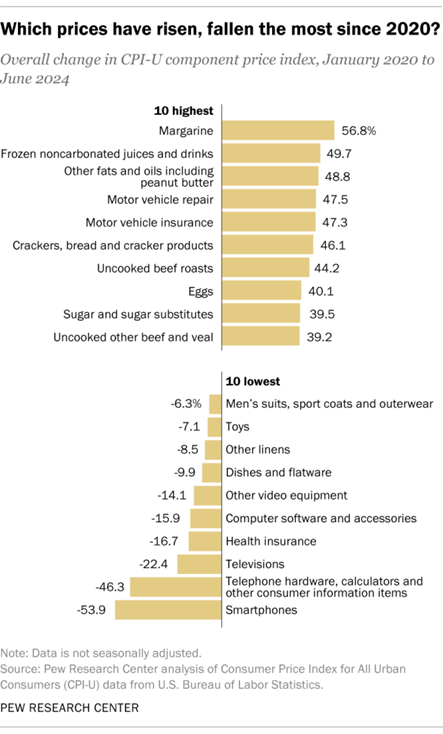

- Inflation’s Hidden Costs: While inflation appears to be cooling, prices remain significantly higher than pre-2020 levels, leaving consumers to face lasting financial strain.

-

- Bitcoin as a Hedge: CHPG views Bitcoin as a strategic treasury asset to protect against the ongoing devaluation of the U.S. dollar driven by unlimited money printing.

-

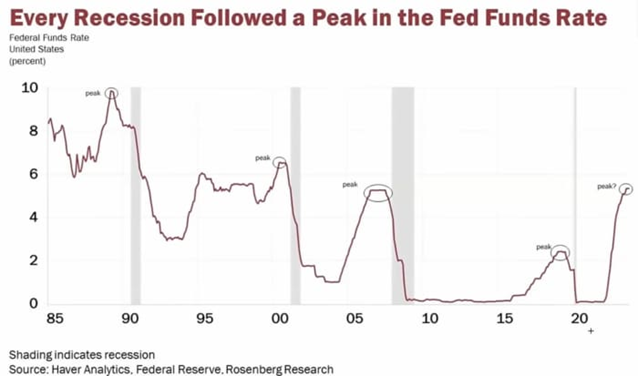

- Rate Cuts and Recession Risks: Historical trends suggest that nearly every rate-cutting cycle has either preceded or coincided with a recession, raising concerns about the current economic outlook.

-

- Election and Cryptocurrency: The 2024 U.S. election could significantly impact the cryptocurrency industry, with candidates like Donald Trump advocating for a national Bitcoin reserve, which could boost crypto adoption and value if implemented.

Navigating the Economic Maze: Jobs, Inflation, and Uncertain Data

Let’s dive right into the current state of the economy because it’s clear that things aren’t always as they seem. From job revisions that paint a less rosy picture than previously reported to inflation metrics that don’t fully reflect the day-to-day realities faced by Americans, economic data is proving to be as fluid as the policies influencing it, making it somewhat challenging not to think this is one of the world’s greatest gaslighting schemes. It’s time to cut through the noise and take a closer look.

Job Revisions Galore The widely reported strong job market since the collapse of SVB and Signature banks in March 2023 may have been overstated, as a 2024 Bureau of Labor Statistics (“BLS”) revision revealed a downward adjustment of 818,000 jobs in total nonfarm employment between March 2023 and March 2024. In short, the reported job creation numbers that allegedly exceeded expectations over the past several months do not reflect reality. Most of the downward revisions were in professional and business services (358,000 jobs), retail (129,000), manufacturing (150,000), and leisure and hospitality (150,000). Interestingly, government jobs were revised upward by a thousand.

Data Discrepancies: Eroding Trust in Economic Reporting and Decision-Making

The disparity between the actual state of the economy and its portrayal in the media raises two primary concerns related to trust in the BLS numbers. First, if the Federal Reserve is truly data-dependent in its decisions, how can it make sound decisions when the data driving its calculus fails to accurately reflect the economy? While the Fed likely draws data from various sources, it’s reasonable to assume that a leading government institution like the BLS, reporting widely used statistics that influence many public decisions, could significantly impact general sentiment. Furthermore, these consistent inaccuracies in employment reports from the BLS can heighten uncertainty and erode trust, particularly given the Fed’s reliance on accurate data to manage its dual mandate of employment and inflation. Second, what is causing BLS to make these significant job revisions so frequently? Without further explanation, the public is left to accept this information without question. Surprisingly, even high-ranking government officials, such as U.S. Commerce Secretary Gina Raimondo, admitted on national television that she was unaware of these revisions, despite her key role in promoting economic growth. This ongoing discrepancy between reported data and reality not only undermines confidence in the BLS but also raises broader concerns about the reliability of economic decision-making at the highest levels of government.

CPI Not Reflecting the Actual State of Prices

The recent Consumer Price Index (“CPI”) showed prices cooling to 2.9% annually, nearing the Fed’s 2% target, but even with normality on the horizon, consumers are still facing higher prices. The decline can be attributed to the Fed holding rates steady and quantitative tightening, which makes borrowing more expensive and reduces inflationary pressures. However, the decelerating prices fail to reflect the cumulative price increases over time. Instead, consumers are still facing much higher prices than they were in 2020.

Although this deceleration reflects the Fed’s ability to manage increasing costs, the Fed has failed to address the cumulative increase in prices we’ve experienced since 2020, when consumer prices for citygoers were 22% cheaper. So, while the media celebrates inflation falling towards the feds 2%, the issue of perpetually rising prices still plagues Americans. And the likelihood of Americans ever seeing pre-COVID prices would require a significant deflationary period at a significant economic cost. To put that “cost” in perspective, some of US history’s most notable deflationary periods occurred during the Great Depression, post-World War I, the Great Recession, and the late 19th century. Without that kind of economic pain, consumers face the classic military axiom of ‘do more, with less.’

Back of the Napkin Economist’s Take

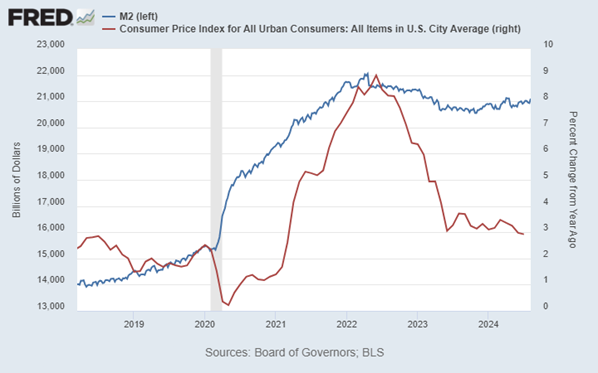

From a monetarist perspective, the 25% increase in the money supply within the past four years has largely contributed to the inflationary pressures the Fed is combatting today. While money supply isn’t the sole cause of inflation, the quantity theory of money can help us better understand its role as a contributing factor. The quantity theory of money depicted by the Fisher formula states that the money supply (M) multiplied by the velocity of money (V) is equal to the average price (P) level multiplied by the volume of transactions (T) in the economy: M x V = P x T. With V and T as constants it’s common sense to think that flooding the economy with money would increase prices. Of course competing Keynesian and Austrian economists might argue over the nuances of how exactly an increased money supply creates upward inflationary pressures. But the general premise remains the same: increase the money supply, and you will increase market prices.

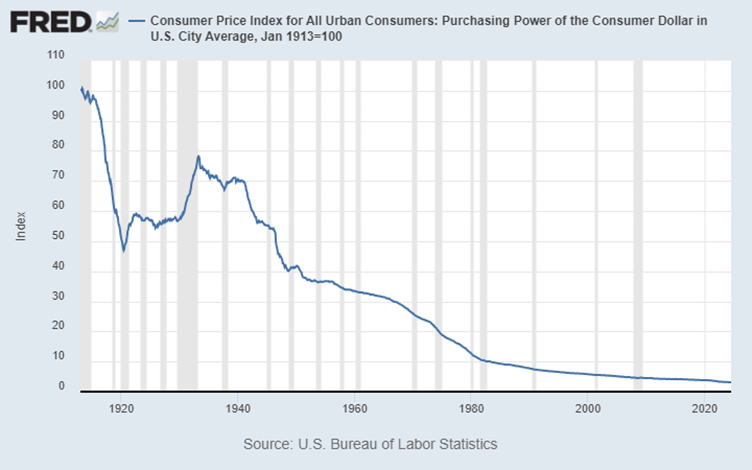

The Inflation Dilemma: Can Endless Money Printing Drive Prices Up Forever? This raises a disconcerting question: If the U.S. government can create money at will, won’t prices continue to rise indefinitely? The answer is yes—so long as the U.S. continues to issue an unlimited number of dollars, the increased money supply will drive up the cost of goods and services, as more dollars chase the same finite resources. Luckily, CHPG aims to address this issue by holding Bitcoin (“BTC”) as a treasury asset, using it as a hedge against the devaluation of the U.S. dollar (“USD”), driven by the government’s willingness to print money without recognition of the consequences. Since Bitcoin has a fixed maximum supply of 21 million coins, it cannot be artificially increased like fiat currency.

Bitcoin vs. Inflation: Preserving Purchasing Power

The value of 1 BTC will always equal 1 BTC, while its price in USD fluctuates based on the supply and demand of US dollars. For example, if you had $100,000 in savings in 2020, your purchasing power would have decreased over 20% by 2024 due to inflation. Inflation that was influenced by expansionary monetary policies, i.e., COVID-19 spending bills, voted on by your elected representatives. In contrast, holding those same savings in BTC would have preserved or even increased your purchasing power, depending on Bitcoin’s performance during that period. It’s important to note that Bitcoin’s price can be highly volatile, especially as it matures as an asset class. However, the core idea remains: saving in USD exposes your wealth to the risk of inflation eroding its value while saving in Bitcoin offers a hedge against inflation and potential price appreciation. Of course, volatility is the trade-off you’ll face in the short term as Bitcoin adoption grows over time.

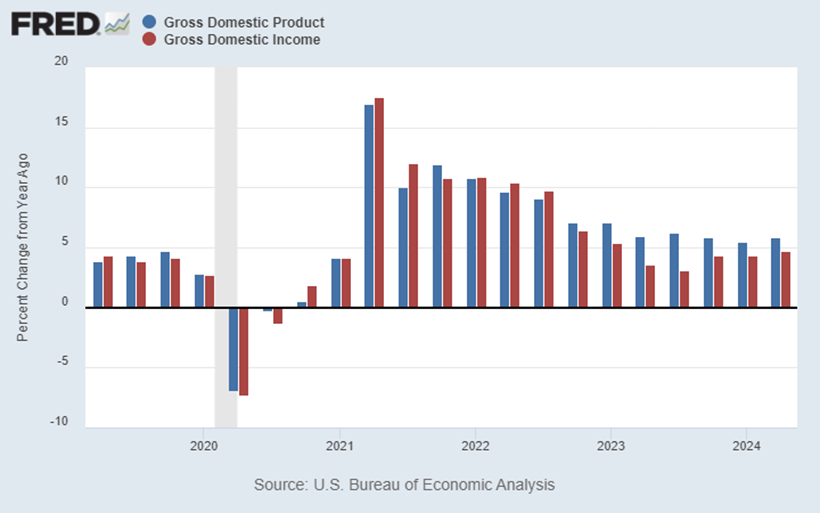

GDP GDI Mismatch

The Bureau of Economic Analysis (“BEA”) released Q1 2024 GDP and GDI figures, showing annualized growth of 3.0% and 1.3%, respectively. Notably, GDI has demonstrated a pattern of lagging GDP for the past seven quarters, a disparity often attributed to data collection errors. However, the frequency and magnitude of this gap could signal underlying economic or structural issues that have not yet been addressed. This discrepancy complicates policymakers’ ability to understand the economy fully, raising questions about how they can make sound decisions with incomplete data. As a point of clarification, Gross Domestic Product or GDP measures the total value of goods and services produced in a country, focusing on expenditures, while Gross Domestic Income or GDI measures the total income earned by labor and capital in producing those goods and services. Though conceptually these figures should align, they often diverge due to differences in data sources and revisions. However, a continued pattern of disparity, like we see here, may indicate a larger issue in the economy.

Federal Reserve Rate cut externalities

Jerome Powell noted that during the FOMC’s July meeting, there were discussions about a potential rate cut from the current 5.5% discount rate, though he emphasized that consistent signs of inflation returning to the Fed’s 2% target would be necessary before acting. A Fed rate cut would likely lead to increased borrowing by businesses and consumers due to lower interest rates. Lower interest rates would typically reduce the returns on safer investments like US Treasuries, pushing investors toward riskier assets to achieve higher yields. This, in turn, could result in higher asset prices as investors shift to riskier assets like stocks, real estate, and other assets in search of better returns than provided. Furthermore, such a rate cut could also contribute to monetary and asset inflation if such borrowing and spending increases economic demand at a pace faster than the economy can absorb, putting upward pressure on prices. Lastly, it’s worth noting that nearly every rate-cutting cycle has either preceded or coincided with a recession, as the delayed effects of earlier rate hikes often cause economic slowdowns, prompting the Fed to reduce rates in response.

Bitcoin…Political Football or Future Strategic Reserve Asset?

Welcome to the election coverage section of the CHPG newsletter, where we discuss… well, the election, of course. More importantly, we discuss the impact the election will have on the cryptocurrency industry and, by extension, CHPG.

By: Billy Pilgrim

Trump, Bitcoin, and the Battle for the Blockchain Vote: The Real SEC Showdown (Sorry, Football Fans)

Let’s get right to it. Former President Donald Trump recently attended Bitcoin2024 and commented on Robert Kennedy’s plan regarding the creation of a national strategic reserve of BTC. Why is this important? Let’s start off with the low-hanging fruit. Votes and Money. President Trump wants the votes of the approximately 18 million holders of BTC in the United States. Furthermore, he wants the estimated $170 million of SuperPAC’s, most notably Fairshake, for his campaign. Obviously, more money equals more exposure but what is interesting to note is the track record that a SuperPAC like Fairshake has in primaries, 33-2. Not too shabby. It would not be unreasonable to assume that President Trump also would want to incorporate the political and industry expertise from Fairshake not only for the purpose of winning the Presidency but also to inform and reign in the overreach of Gary Gensler and the SEC (Securities and Exchange Commission, not to be confused with the real SEC, sorry college football fans).

Notably absent from President Trump’s speech was any inclination of how such a strategic reserve would be implemented, managed, or acquired and held. Honestly, at first glance, it sounds like an empty campaign promise, but to be fair President Trump has always been a salesman and never came across as much of a “how to” kind of guy. More practically important for CHPG and our readers, assuming such a plan comes to fruition, it would cause an immediate lift in the price of cryptocurrencies and CHPG’s holdings as well as signal to the market that BTC has the confidence of the U.S. Government. Government recognition would help legitimize BTC and crypto as a viable medium of exchange in the eyes of those not in tune with the digital asset landscape. In essence, it could act as a network effect that rapidly increases the adoption rate of BTC. Once again, as BTC becomes more utilized, its value will continue to increase, similar to the price of most blockchain company tokens.

However, the political implications of BTC reducing government spending may turn out to be the best benefit. Since shifting away from the gold standard, inflation generally rises as monetary supply increases. No surprise there; you increase the supply of money the more things cost. Since there is no theoretical limit on how much money can be printed as there isn’t a tangible asset to back the USD, one could argue that budget deficits don’t matter. The promise of a debt ceiling looks more like a political bargaining chip rather than fiscal restraint; all the while, the bureaucratic bloat gets larger every day. The average person’s purchasing power declines, resulting in you working harder but taking home less. The classic double taxation of inflation. Instituting BTC as a strategic reserve would help curb government spending, increase accountability, and peg the USD to a fixed asset. BTC’s price would act as a transparent feedback loop for fiscal responsibility, rising with excessive money printing to signal decreased purchasing power and stabilizing under controlled government spending to indicate a stable dollar.

Job Revisions Galore The widely reported strong job market since the collapse of SVB and Signature banks in March 2023 may have been overstated, as a 2024 Bureau of Labor Statistics (“BLS”) revision revealed a downward adjustment of 818,000 jobs in total nonfarm employment between March 2023 and March 2024. In short, the reported job creation numbers that allegedly exceeded expectations over the past several months do not reflect reality. Most of the downward revisions were in professional and business services (358,000 jobs), retail (129,000), manufacturing (150,000), and leisure and hospitality (150,000). Interestingly, government jobs were revised upward by a thousand.

Harris Campaign Dodges Bitcoin Policy Position

Moving on to the other side of the aisle, the Harris Campaign has remained seemingly silent about BTC and crypto. The Democrats’ official ninety-two-page platform does not mention digital assets at all. However, one could speculate that crypto might be targeted for new taxes similar to the recently proposed increases to capital gains taxes announced by the Harris Walz campaign. Furthermore, thanks to reporting from Axios, we know that key Harris staffers have a track record of killing pro-crypto legislation.

What does this really mean? Actions speak louder than words, and many Democratic SuperPAC donors are from established industries like Banking. Any transactions outside of the toll road-heavy tracks of Visa, Mastercard, and the ACH will most likely be viewed as a threat to traditional finance. Consequently, under Democratic leadership, crypto exchanges may face increased regulatory scrutiny and potentially higher tax burdens, which could significantly impact their operations and business models. In short, we think Democrats favor stricter oversight, which could lead to two potential outcomes: make crypto appear to be the least attractive option over traditional methods and cash or establish covert stringent digital asset regulations under the guise of simply mentioning cryptocurrency as a campaign policy initiative.

Kennedy the Crypto Wildcard: Blockchain Budgets, Bitcoin Reserves, and Tax-Friendly Policies

Wildcard. What’s RFK gonna do? Who knows? Kennedy recently endorsed former President Trump and is likely to influence any proposed policy by the Trump campaign. Kennedy likes crypto and has some interesting takes on where to go with the industry and the US Economy. His most notable proposals include 1) putting the U.S. Federal Budget on a blockchain, 2) tax-friendly crypto policies, and 3) creating a BTC currency reserve via a 550 daily BTC purchase plan.

Let’s unpack putting the federal budget on a blockchain. Greater accountability and transparency are definitely a plus for taxpayers, as well as the potential cost savings of not having to employ as many accountants, auditors, and bureaucracy in general to maintain the budget. The idea makes sense, yet in our eyes the problem isn’t so much that the U.S. Government (“USG”) is not accounting for all its spending, but rather that the USG is issuing debt to finance the increasing budgetary deficit. It feels more like a “band aid on a bullet wound” proposal with high initial startup costs. However, the idea seems reasonable because it offers transparency into a system where the Department of Defense has failed to account for about half of its $3.8 trillion in assets.

No taxes on crypto. This is probably the most interesting proposal. People respond to incentives, and if the USG incentivizes tax-free crypto, then we could see a huge wave of BTC investment. Such a policy could act as an impetus for everyone from retail investors to high net-worth individuals, endowments, pension funds, etc., to place large portions of their portfolios in crypto. As a result, this could raise the value of BTC, further accelerate adoption, and fuel the growth of new point-of-sale payment methods.

Daily BTC Purchase. The idea of a Daily BTC purchase plan is essentially a form of dollar cost averaging, setting aside a set amount to purchase regardless of the market price, a common theme among the set-it-and-forget-it index holders. Over the long term, RFK has stated that he would aim to acquire 4 million BTC, which could become extremely expensive or cause the market supply to dry up. Think about it: if individuals or institutions simply hold onto their Bitcoin while the U.S. government reduces the available supply, the value of each Bitcoin would increase substantially.

This is where CHPG stands to gain significant ground. As CHPG continues to hold and never sell its Bitcoin, our holdings will appreciate in value. Moreover, as Bitcoin becomes a more widely accepted asset, it can be used as a revenue-generating asset to fuel further growth via custodial and lending operations. This will be achieved by financing future acquisitions with CHPG’s Bitcoin holdings as collateral and, in the future, providing lending services to businesses and consumers that also recognize BTC as a collateralizable asset. Although decentralized finance is in its ifancy the general concept for us could involve directly to crypto lending platforms to earn interest or utilize strategies like writing covered call options on the open market to generate additional income. While cryptocurrency markets’ future and political dynamics remain uncertain during this election cycle, CHPG is positioned to move swiftly and seize opportunities. The outlook for CHPG is bright.

Of course, we can’t wrap this up without mentioning our core focus: CHPG actively invests in the future economy, with a strategic focus on cybersecurity, digital assets, trade and construction services, and specialized commercial real estate. Our mission is to shape the future by investing in the sectors that will define tomorrow’s economy. In short, we buy and upgrade small—to medium-sized businesses in economically resilient industries and hold Bitcoin as a treasury asset.